Market Research for Small Business Made Simple

Think of market research as your secret weapon. It’s what transforms a brilliant idea into a business that actually makes money. At its heart, it’s all about gathering solid information about your customers, competitors, and the industry you’re in. This isn't about guesswork; it's about making smart, data-backed decisions.

Why Market Research Is Your Business Lifeline

Let's bust a common myth right now: market research isn't some luxury reserved for giant corporations with bottomless budgets. For a small business, it's the single most important tool you have for survival and growth. It's the difference between launching a product to a cheering crowd and launching it to the sound of crickets.

Good research helps you dodge the kind of mistakes that can sink a business before it even gets going. It acts as your compass, steering you away from building something nobody wants, pricing yourself out of the market, or shouting your message at the wrong people.

To build a strong foundation for your business, it's essential to investigate a few key areas. The table below breaks down what you need to know and why it's so critical for making informed decisions.

Key Areas of Small Business Market Research

| Research Area | Key Question to Answer | Why It Matters for Your Business |

|---|---|---|

| Your Target Customer | Who are they, what do they struggle with, and what drives their buying decisions? | This ensures you build a product they actually want and craft marketing that resonates with them on a personal level. |

| Your Competition | Who are my direct and indirect competitors, what are their strengths, and where are their weaknesses? | Finding their weak spots reveals your opportunity to stand out and capture a share of the market. |

| Industry & Market Trends | What new technologies, consumer behaviors, or regulations are shaping my industry? | This helps you stay ahead of the curve, adapt your strategy, and innovate before your competitors do. |

By digging into these questions, you stop relying on vague assumptions and start operating with concrete facts. This clarity is what gives you the confidence to make the right calls on everything from your product features to your marketing copy.

How Research Helps You Avoid Costly Mistakes

The reality for new businesses can be tough. Statistics show that roughly 22% of small businesses don't make it past their first year, and that number jumps to about 50% by year five. The top culprits? A lack of market need and running out of cash.

Solid research is your best defense against becoming another statistic. It validates that people are actually willing to pay for what you’re selling. You can dig deeper into why businesses fail and how to sidestep those issues by reviewing these small business statistics.

Here’s a real-world example I saw unfold. A local bakery was all set to launch a line of fancy, high-end cakes. But first, they ran a simple survey. It turned out their customers—mostly busy parents—were far more interested in quick, healthy, and affordable breakfast items. That small bit of research saved them from pouring money into a product line that was destined to flop.

This isn't just about avoiding failure; it's about setting yourself up for success. Every piece of data you collect informs your strategy. Knowing that nine out of ten consumers read online reviews before making a purchase, for example, tells you just how important it is to keep an eye on your digital reputation.

While you could spend hours manually pulling this kind of information from websites, you can speed up the process significantly. A no-code tool like the Ultimate Web Scraper Chrome extension from PandaExtract can automate this data collection, giving you the insights you need without the manual grind. Ready to try it? Download our Chrome extension here.

Setting Clear Goals for Your Research

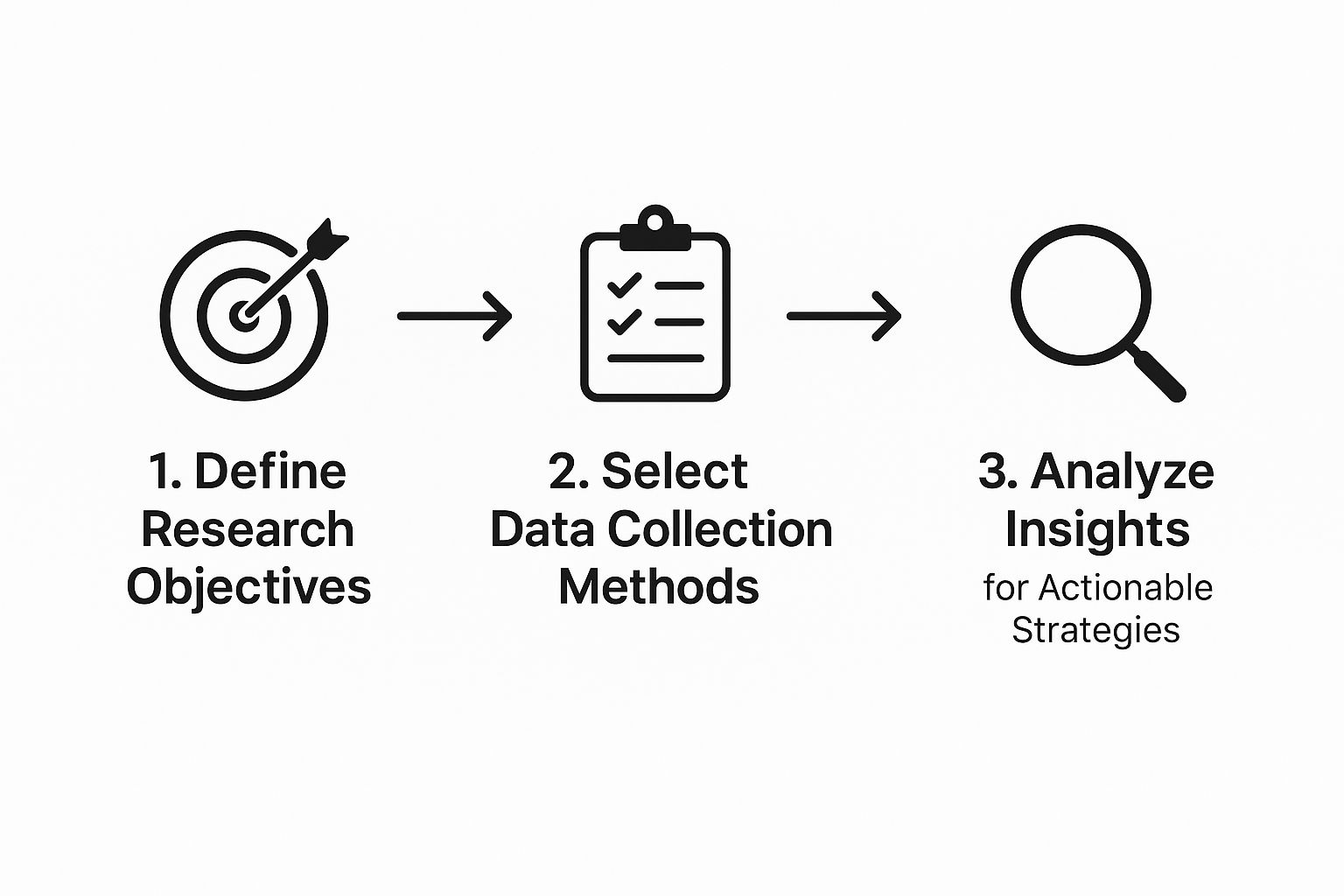

Before you dive into collecting data, you need a plan. Trust me, jumping in without clear goals is a surefire way to waste a ton of time and end up with a pile of confusing information. Great market research doesn't start with data; it starts with a question. Your first move is to turn those big, vague ideas into sharp, actionable objectives.

Saying you want to "understand the market" is a classic example of a goal that's too broad to be useful. Instead, ground your research in a real business decision you need to make. A much better objective would be: "Pinpoint the primary demographic for our new organic soap line and figure out what they're willing to pay." See the difference? That specific goal gives your work a clear purpose and direction from day one.

Brainstorming Your Business Questions

A great way to get started is to think through the core pillars of your business. Frame your thoughts as questions that will help you figure out what you really need to know. Make sure every single question is tied to a decision you’ll have to make down the road.

- Product: What problem is my product actually solving for people? Are there any specific features my dream customers would happily pay extra for?

- Pricing: How much do people think my product is worth? How do my prices stack up against my closest competitors?

- Distribution: Where do my target customers typically buy products like mine? Are they shopping online, in small specialty shops, or at local farmers' markets?

- Promotion: Which social media channels does my audience live on? What kind of message will actually make them stop scrolling?

Once you've got your goals locked in, the next step is to get inside your customers' heads. You can explore various proven audience research methods to start gathering initial insights into their habits and what makes them tick. This keeps your research firmly centered on the people who matter most—your customers.

Creating a Simple Research Brief

Don't let the term "research brief" intimidate you. This doesn't need to be some formal, 20-page report. A simple one-pager is often all you need to keep your project on the rails. Think of it as your roadmap, making sure every task you undertake is intentional and pushes you toward a concrete business outcome.

A simple brief is your best defense against "scope creep"—the tendency for research projects to become bigger and more complicated than necessary. It keeps you focused on answering only the questions that matter for your immediate business decisions, saving you valuable time and money.

For instance, imagine a local café wants to launch a delivery service. Their brief might focus on finding local business leads. A key task would be identifying every office building within a two-mile radius. This is a perfect use case for a tool that can help you scrape Google Maps for local business information, letting you gather that specific data efficiently.

This kind of disciplined approach ensures your market research for small business delivers clear, actionable answers—not just a mountain of data you don't know what to do with.

Gathering Market Data Without Breaking the Bank

With clear objectives in hand, it's time to roll up your sleeves and find the information that will actually guide your business decisions. For a lot of small business owners, this is the part that feels overwhelming, mostly because it sounds expensive. But here’s the good news: you can get incredible market intelligence without a massive budget.

The trick is to use a smart mix of two kinds of research: primary and secondary. Primary research is brand-new information you gather yourself, while secondary research is data that's already out there for the taking. Combining both gives you the most complete view of the market.

Tapping into Primary Research on a Shoestring

Primary research means going straight to the source—your potential customers. This is where you get the real, unfiltered feedback that can change everything. Best of all, it doesn't have to cost a fortune.

Here are a few low-cost ways to get started:

- Online Surveys: Tools like Google Forms are completely free and perfect for this. My advice? Keep your surveys short, focused, and easy to complete on a phone. You’ll get way more responses.

- Customer Interviews: Don't underestimate the power of a simple conversation. Just talking to a handful of your existing customers or people in your network for 15 minutes can yield more gold than a 100-question survey ever could.

- Informal Focus Groups: Think of it as a casual coffee chat. Gather a small group of people who fit your target audience, offer them some coffee and donuts, and just listen to their honest opinions about your idea. It’s incredibly insightful.

As you can see, once you know your goals, picking the right method becomes much simpler, and that path leads directly to insights you can actually use.

Finding Hidden Gems with Secondary Research

Secondary research is your secret weapon for speed and efficiency. It’s all about digging into the mountains of information that already exist, right from your desk.

You can start with government sources like the U.S. Census Bureau, which offers a treasure trove of free demographic data. Trade associations often publish industry reports that can give you a handle on market size and trends. And don't forget social media—platforms like Reddit and Twitter are goldmines for seeing what real people are saying about your niche.

But if you ask me, the most potent secondary research comes from sizing up your competition. What are they selling? What are their prices? What do their customer reviews say? Knowing the answers gives you a serious edge.

The only problem is that collecting this information manually is a real grind. Digging through website after website is slow and tedious, which is why automating the process is a game-changer.

This is where a simple tool like PandaExtract can save you a ton of time and headache. Instead of copy-pasting for hours, our no-code web scraper lets you pull structured data—like product lists, prices, and features—from competitor websites in minutes. You can learn more and grab the PandaExtract Chrome extension to see for yourself.

By automating this part of your market research for a small business, you’re not just saving time. You’re freeing yourself up to do the most important work: figuring out what all that data actually means for your business.

How to Analyze Competitors and Find Your Edge

Let's be clear: understanding your competition isn't about copying what they do. It’s about strategically uncovering what they don't do. This is a cornerstone of smart market research for a small business, and it’s how you find your unique, profitable spot in the market.

Your first step is to figure out who you're really up against. This means looking beyond the obvious. You have direct competitors, who offer a similar product to your exact audience, but you also have indirect competitors, who solve the same problem with a completely different solution.

Think of it this way: a specialty coffee shop's direct competitor is the café down the street. An indirect competitor? It could be the company selling high-end energy drinks that promise focus and a morning boost. Both are vying for the same customer wallet.

Uncovering Competitor Strategies

Once you have a list, it’s time to put on your detective hat. The goal is to dissect their business from a customer’s point of view. You need to look at everything—their product lineup, their pricing, how they talk to customers, and where they show up online.

This deep dive helps you spot the patterns. Are they all in a race to the bottom on price, or are some building a premium brand? What social media channels are they all using? You're looking for the gaps, the cracks in their strategy where your business can shine.

In 2025, with an estimated 400 million small and medium-sized businesses globally, carving out your digital space is non-negotiable. And considering that 90% of bloggers are actively pushing out content, you can bet your competitors are trying to win with content marketing.

Performing a Simple SWOT Analysis

To make sense of everything you've learned, a simple SWOT analysis is your best friend. This isn't just a stuffy business school exercise; it's a practical framework for turning messy research into a clear action plan. It breaks down what you've found into four crucial areas.

- Strengths: What do you do better than anyone else? This could be a unique product, incredible customer service, or a compelling brand story.

- Weaknesses: Where do your competitors have you beat? Be brutally honest. Is it your budget? Brand recognition? A smaller team?

- Opportunities: What market gaps did your research reveal? Maybe it's an underserved niche, a new trend no one is talking about yet, or a common complaint you keep seeing in competitor reviews.

- Threats: What outside forces could hurt you? This could be new players entering the market, shifting regulations, or a change in what customers value.

A well-done SWOT analysis is a reality check. It forces you to see your business and the market with total clarity, helping you pinpoint your Unique Selling Proposition (USP)—that one thing that makes you the only choice for your ideal customer.

Manually digging through websites, social media, and review platforms to get this information is a huge time sink. You can check out our guide on how to scrape local business leads without code to learn how to gather this data far more efficiently.

For an even faster, more automated approach, a data extraction tool is invaluable. Our Ultimate Web Scraper Chrome extension can automatically pull competitor product details, pricing, and customer reviews from any website. It saves you dozens of hours of grunt work and gives you a clean, organized view of the competitive landscape so you can focus on what really matters: finding your edge. Start automating your research by downloading the Chrome extension now.

Turning Your Research Into Actionable Decisions

So, you've done the hard work. You've run the surveys, conducted the interviews, and dug deep into what your competitors are doing. Now you're sitting on a pile of raw data. This is the moment where research stops being an academic exercise and starts shaping the future of your business.

The first step is to simply look for the echoes. What patterns or themes keep popping up across all your different data sources? Did you hear the same frustration mentioned in three separate interviews? Did your survey results overwhelmingly favor one feature over another? These are your signposts. Your job is to connect these dots to either confirm your original gut feelings or recognize it's time to pivot.

From Insights to a Concrete Plan

Once you've spotted the major themes, it's time to build a plan. This doesn't need to be some hundred-page document. Think of it more as a simple, direct bridge connecting what you learned to what you'll do.

Let's say your research uncovered a surprise: your target audience is far more interested in eco-friendly packaging than they are in saving a couple of bucks. Suddenly, your path forward becomes much clearer.

- Action 1: Start hunting for sustainable packaging suppliers that fit your budget.

- Action 2: Rework your website copy and marketing materials to shout about your new eco-conscious commitment.

- Action 3: Adjust your pricing, knowing your customers will appreciate the value behind the change.

This is how you make decisions based on evidence, not just hope. And once you have this kind of data, you can build much more effective marketing tips for small businesses because you know exactly what your audience wants to hear.

The smartest small businesses I've seen don't treat research as a one-and-done task. They build it into their DNA. It's a constant cycle: learn, adapt, act, and then learn again.

Keeping this loop going is more critical than ever. The global small business market was valued at around USD 2.572 trillion and is expected to balloon to USD 4.985 trillion by 2032. That explosive growth, driven by digital tools and e-commerce, means the ground is always shifting beneath our feet. Staying informed isn't optional.

Making sense of all this information requires some organization. For example, if your research points you toward specific professionals on networking sites, you need a system to handle that data. A great starting point is learning how to export leads from Sales Navigator to Excel or CSV, which gives you a practical workflow for managing those contacts.

Alright, even with the best-laid plans, a few nagging questions can pop up when you start digging into market research. Let's walk through some of the most common ones I hear from small business owners, so you can tackle this process with real confidence.

How Often Should I Be Doing Market Research?

Market research isn't a one-time project you complete and then file away. Think of it more like an ongoing conversation with your customers and your industry. You’ll definitely want to do a deep, comprehensive study when you're first launching your business or introducing a significant new product. That’s non-negotiable.

After that initial push, it’s all about maintenance and staying sharp.

A good rule of thumb is to schedule a formal research "check-up" at least once a year. This is your chance to take a bigger-picture look at industry trends and what your competitors have been up to. But don't stop there. The real magic happens when you weave data gathering into your everyday operations. Simple things like post-purchase surveys, monitoring your online reviews, or just having real conversations with customers provide a constant pulse on what’s happening. The goal is to stay nimble.

Can I Actually Do Market Research With No Budget?

Yes, absolutely. Having a budget for fancy tools or research firms can certainly speed things up, but some of the most eye-opening insights come from methods that cost you nothing but your time. Honestly, your most valuable asset here isn't cash—it's your willingness to get curious and do the digging yourself.

Here are a few ways to get started without spending a dime:

- Whip up free surveys. Use a tool like Google Forms to poll your email list, social media followers, or professional network.

- Talk to people. Seriously, a few informal 15-minute chats with current customers or even contacts in your industry can be incredibly revealing. Just ask what they think.

- Become a digital sleuth. Manually go through your competitors' websites and social media feeds. How are they talking about their products? What are their customers saying in the comments? The clues are all there.

- Tap into public data. Government resources like the U.S. Census Bureau offer a goldmine of demographic information that can help you understand your target area.

What Is the Biggest Research Mistake I Need to Avoid?

If there's one pitfall that can completely derail your efforts, it’s confirmation bias. We all have it. It’s that sneaky human tendency to cherry-pick the data that proves what we already believe and conveniently ignore anything that challenges our assumptions. It’s a dangerous blind spot.

Imagine you're absolutely convinced a new product feature is a game-changer. Confirmation bias is what makes you fixate on the two customers who loved the idea, while dismissing the twenty who said they’d never use it.

To beat this, you have to approach your market research for a small business with genuine curiosity. You have to actively look for the feedback that stings a little. Be open—even excited—to find out you were wrong. The data isn't there to make you feel right; it’s there to show you the right path forward.

Here at PandaExtract, our mission is to make powerful data simple and accessible. To put your data gathering on autopilot for everything from competitor analysis to price tracking, give our no-code tool a try.

Download the Ultimate Web Scraper Chrome extension and start making smarter, data-backed decisions today.

Published on